Contents:

Investors may prefer corporate bonds over government bonds, given better corporate fundamentals. The financial sector is the most sensitive to changes in interest rates. When interest rates climb, so do profit margins for businesses like banks, insurance companies, brokerage firms, and money managers.

Bears argue Walmart has few growth opportunities remaining as its U.S. segment has limited prospects for new store openings, and its international revenue is falling. But with an increased focus on e-commerce, the firm is better positioned to reach new customers that may never walk into any of its stores. Metals and machinery makers like Caterpillar are rallying on the prospect of higher government spending will boost demand for makers of construction materials and infrastructure engineering and design companies. The last few months have been great for the company after the pandemic ravaged its four reportable segments. The Central Bank usually increase interest rates when inflation is predicted to rise significantly above their inflation target.

Part of this has to do with the fact that higher rates mean they can charge more interest on loan products. If a bank can charge you a higher interest rate on a mortgage or a credit card, it can make more money. The bank hasn’t lent you any more, but they receive a higher return.

Are Bonds Good Investments When Interest Rates Rise?

The unexpectedly high inflation of 2022 caused by rising oil prices, post-covid disruptions forced the Bank of England to raise interest rates from historic lows. Higher interest rates increase the cost of government interest payments. Commodity prices usually rise when inflation is accelerating, and therefore some choose to invest in this asset class to hedge against inflation. Jefferies sees inflation reaching at least 2%, and shares 4 sectors that stand to benefit. Purchases made before interest rates begin to significantly rise can result in substantial savings in financing charges and overall long-term costs.

Investment cycle reviving after 10 years. Instead of sectors, be stock specific: Rahul Singh – The Economic Times

Investment cycle reviving after 10 years. Instead of sectors, be stock specific: Rahul Singh.

Posted: Tue, 25 Apr 2023 05:12:00 GMT [source]

Despite this, investors remained bullish about the economy, sending the Sensex to a record high by mid-July. Led, by gains in banking and energy stocks, Nifty also breached the 11,000 mark. In other words, policymakers raise interest rates to curtail the money supply and dampen inflationary pressure. That’s because higher interest rates encourage people to save more and spend less.

Meme Stocks to Buy With Actual Growth Potential

Low interest rates and price hikes in some areas of the market have triggered inflation concerns. The FOMC is meeting for two days this week to discuss interest rates and monetary policy. Investing with portfolio managers who have a flexible approach can help you preserve your capital.

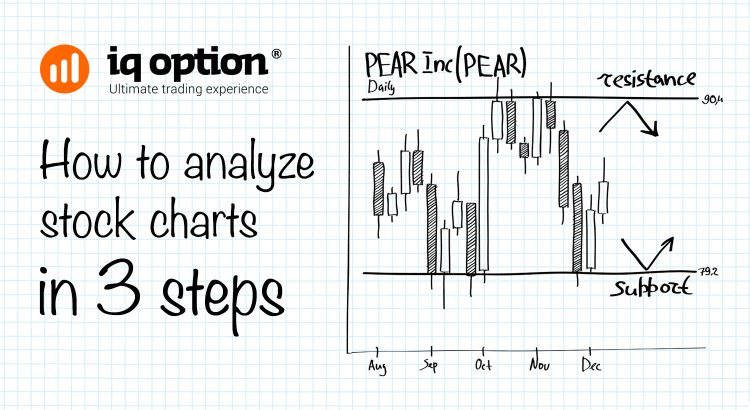

So if rates rise, so too does the rate on your loan or mortgage. One balanced approach when interest rates are rising is to stay invested and take advantage of late-stage positive momentum, but you should also prepare for harder times that are lurking around the corner. Take a look at the best stock funds and stock sectors when interest rates go up.

- Blowout deficit spending now looks like it will be the new normal.

- Higher interest rates increase the cost of government interest payments.

- What remains a silver lining for the investors is the robust growth witnessed in the corporate earnings in the recent earnings season.

- Take a look at the best stock funds and stock sectors when interest rates go up.

Insurers, which have steady cash flows, are compelled to hold lots of safe debt to back the insurance policies they write. In addition, the economic health dividend also applies to insurers. Improving consumer sentiment means more car purchasing and improving home sales, which means more policy-writing. Bond funds behave similarly to stocks in an environment of rising interest rates. That is why many investors will rush to buy short- or intermediate-term bonds, expecting that rates may continue to rise on long-term bonds.

How Do Interest Rates Affect Stocks?

At times, a rise in interest rates may have less impact on reducing the growth of consumer spending. For example, if house prices continue to rise very quickly, people may feel that there is a real incentive to keep spending despite the increase in interest rates. However, some sectors stand to benefit from interest rate hikes. One sector that tends to benefit the most is the financial industry.

Think truck part manufacturers who see an increase in demand as building ramps up or appliance manufacturers who need to outfit new homes. Interest rate risk is only one component, but it can be an important item to pay attention to when managing your portfolio and creating a long-term strategy. Publicly listed companies may be extra vulnerable to interest rates and inflation. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Market Dashboard

Our long and https://1investing.in/ positions change frequently, so we make no assurances about our future positions, long or short. The information contained in this article has been prepared with reasonable care using sources that are assumed to be reliable, but we make no representation or warranty regarding accuracy. This article is provided for informational purposes only and is not intended to constitute legal, tax, securities, or investment advice. You should discuss your individual legal, tax, and investment situation with professional advisors.

Another business internet banking that could benefit from higher inflation includes real estate. A bump-up certificate of deposit entitles the bearer to take advantage of rising interest rates with a one-time option to “bump up” the rate paid. Payroll processors generally maintain large cash balances for customers in the periods between paychecks, which is when the money is distributed to their employees as payroll. These firms should see improved interest revenues when interest rates rise. Hedge your bets by investing in inflation-proof investments and those with credit-based yields. You can capitalize on higher rates by buying real estate and selling off unneeded assets.

Savers — On top of that, savers often benefit from rising rates. If you have a portion of your portfolio in money market funds, CDs, and high-yield savings accounts, you can see a benefit from rising rates. Here are some examples of stocks and funds that investors trying to take advantage of rising rates.

Higher interest rates increase the value of a currency A stronger Pound makes UK exports less competitive – reducing exports and increasing imports. This has the effect of reducing aggregate demand in the economy. Expansionary policy is a macroeconomic policy that seeks to boost aggregate demand to stimulate economic growth. The federal discount rate is the reference interest rate set by the Federal Reserve for lending to banks and other institutions.

Higher interest rates tend to negatively affect earnings and stock prices . Any impact on the stock market to a change in the interest rate changes is generally experienced immediately, while, for the rest of the economy, it may take about a year to see any widespread impact. This week is going to be an eventful one for investors as more earnings results and key economic data continue to roll in alongside a Fed monetary policy decision and press conference. Rising interest rates may sound like a bad thing for those who need to take out a loan or buy something on credit, but investors can profit by planning ahead and purchasing the right types of investments. During this period, momentum investors, measured by the MSCI Momentum Index, saw positive returns in all years except 2018.

Thus if interest rates rose from 5% to 6% but inflation increased from 2% to 5.5 %. This actually represents a cut in real interest rates from 3% (5-2) to 0.5% (6-5.5) Thus in this circumstance the rise in nominal interest rates actually represents expansionary monetary policy. The effect of rising interest rates can often take up to 18 months to have an effect. For example, if you have an investment project 50% completed, you are likely to finish it off. However, the higher interest rates may discourage starting a new project in the next year.

Invest in Cash-Rich Companies

When higher interest rates are coupled with increased lending standards, banks make fewer loans. When consumers pay less in interest, this gives them more money to spend, which can create a ripple effect of increased spending throughout the economy. Businesses and farmers also benefit from lower interest rates, as it encourages them to make large equipment purchases due to the low cost of borrowing. This creates a situation where output and productivity increase. Rate reversal will, of course, have an impact on all sectors but the intensity of impact will be different across sectors.

Role of IT Sector in Revolutionizing Pakistan’s Economy – Modern Diplomacy

Role of IT Sector in Revolutionizing Pakistan’s Economy.

Posted: Sat, 29 Apr 2023 09:00:00 GMT [source]

Blowout deficit spending now looks like it will be the new normal. Historically, when governments have overspent, rather than raise taxes, the easier route has been to weaken the value of the currency through inflation, making repayment of government borrowing easier. Members should be aware that investment markets have inherent risks, and past performance does not assure future results. Investor Junkie has advertising relationships with some of the offers listed on this website.

- Conversely, when the Federal Reserve decreases the federal funds rate, it increases the money supply.

- In general, rising interest rates curb inflation while declining interest rates tend to speed inflation.

- Relli is a qualified chartered accountant and has also studied at the prestigious Indian Institute of Management, Bangalore.

These professionals are able to make changes to sector weightings and duration exposures as per market and interest rate swings. Those who aim to time the market with sectors will have the goal of catching positive returns on the upside. At the same time, they’ll want to prepare for harder declines when the market turns down. When interest rates are on the rise, the economy is typically nearing a peak. This is because the Federal Reserve raises rates when the economy appears to be growing too fast.

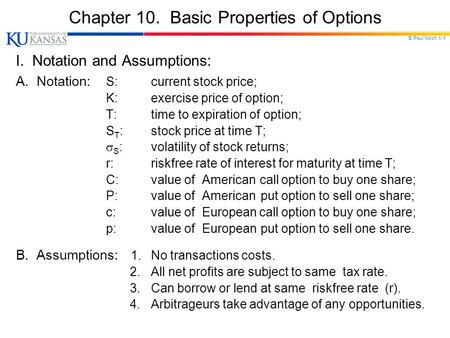

They will usually experience a corresponding increase in interest rates. In other words, the risk-free rate of return goes up, making these investments more desirable. As the risk-free rate goes up, the total return required for investing in stocks also increases.

But their low yields are forcing investors to look elsewhere for a greater degree of income. Short-term and floating rate bonds are also good investments during rising rates as they reduce portfolio volatility. These mutual funds are focused on growth stocks, which have strong projected growth and attractive return on equity.